On 26 October, the China Nonferrous Metals Industry Association (CNIA) silicon branch announced the latest prices for mono-silicon wafers for the week. Specifically: the average transaction price of M10 mono-silicon wafer (182mm/150μm) dropped to RMB2.54 RMB/piece (US$0.34), a week-on-week decrease of 6.96%.

The n-type mono-silicon wafer (182mm/130μm) average transaction price dropped to RMB2.59/piece, a week-on-week decrease of 8.80%. The G12 mono-silicon wafer (210mm/150μm) average transaction price dropped to RMB3.47/piece, with a weekly decline of 4.14%. Since the latter part of September, there has been a noticeable downward trajectory in silicon wafer prices. Chip

Data disseminated by the Silicon Industry Association reveals that the p-type 182 mono silicon wafer is now priced between RMB2.53-2.55/piece. This signifies a significant contraction of up to 24% from its valuation on 21 September. Concurrently, the p-type 210 mono silicon wafer has also experienced a price reduction approximating 25%.

Apart from the CNIA silicon branch, a price monitoring chart from another third-party consultancy, PV InfoLink, also indicates that silicon wafers continue to be affected by inventory buildup, with prices collapsing rapidly. This has precipitated a rapid price deflation, compelling manufacturers to employ a variety of strategies to ensure product dispatch, culminating in a prevailing market sentiment of caution and conservatism. This week underscored this trend with a notable drop in the transaction prices, with the p-type 182 mono silicon wafer reaching RMB2.3/piece.

There appears to be a divergence of opinion among manufacturers regarding the price trend of silicon wafers. Second and third-tier manufacturers focus on selling at low prices to clear inventory. However, some manufacturers are firmly keeping their prices and taking the risk of high inventory levels, betting on future purchasing demands to maintain profits.

Industry insiders point out that the biggest risk for silicon wafer manufacturers currently comes from the production plans of cell manufacturers. With cell manufacturers maintaining full operations, silicon wafer inventory buildup is inevitable and operation is to be adjusted to 80% or less.

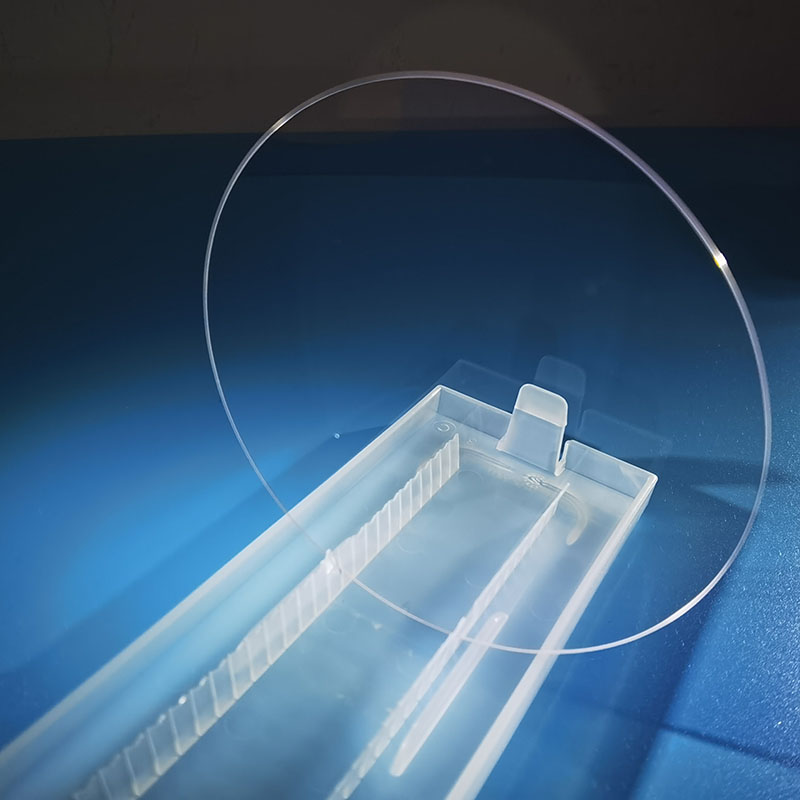

Al2o3 Single Crystal If cell manufacturers reduce production in response to the rapidly declining prices, the production cut for silicon wafer manufacturers may further expand.